what qualifies for home improvement tax credit

The deductions must be considered reasonable and must have a practical use. The 30 tax credit applies to both labor and installation costs.

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions

You can claim a tax credit for 10 of the cost of qualified energy efficiency improvements and 100 of residential energy property costs.

. You would have a. The 30 tax credit applies to both labor and installation costs. Eligible expenses include the cost of labour and professional services building materials fixtures equipment.

Renewable energy tax credits for fuel cells small wind turbines. Under current law if you have owned and lived in the home for at least two of the five years leading up to the sale The first 250000 of profit on the sale of a. If you use your home for business purposes and have a tax-deductible home office the cost of repairs is deductible.

However the amount is limited to the percentage. There are a variety of upgrades you can make to your home that improve your energy use. The energy efficient home improvement credit will however be worth 30 of the costs of all permissible home renovations.

The tax credits for residential renewable energy products are now available through December 31 2023. Examples include geothermal heat pumps solar. Defining Qualified Energy Property For The Home Improvement Tax CreditThe Inflation Reduction Act extended improved and renamed the former Nonbusiness Ener.

However starting in 2023 the credit will be equal to 30 of the costs for all eligible home improvements. In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy. According to the US.

Advanced circulating fans for natural gas propane or oil furnaces. Beginning January 1 2023 there will be a federal tax credit for exterior windows and doors. The Energy Efficient Home Improvement Credit is worth 30 of the total cost of the.

Eligible expenses include the cost of labour and professional services building materials fixtures equipment. Save when you sell. This credit is worth a maximum of 500 for all years.

The Residential Clean Energy Credit under the. The Inflation Reduction Act expands a homeowner efficiency tax credit called the Energy Efficient Home Improvement Credit. Spin Rewriter 80 1 Article Spinner.

Using asphalt roofing qualifies you for the tax credit while you observe other measures and qualifications. This covers up to 30 of the cost of energy. These are all improvements that can be deducted through the medical expense deduction.

The credit is revived for the 2022 tax year and the old rules apply. Start Your Own Online Business. It can be in a traditional form or a modern form.

The Internal Revenue Code qualifies certain types of insulation exterior doors skylights energy efficient windows and many other improvements for this energy credit. Department of Energy homeowners can claim the Residential Energy Efficiency Property Credit for solar wind and geothermal equipment in both their. Your cost basis would be 250000 assuming you didnt make any other improvements that didnt result in claiming a residential energy tax credit.

How To Pay For Home Improvements Bankrate

What Is A Home Improvement Tax Credit With Pictures

Are Home Improvements Tax Deductible It Depends On Their Purpose

2022 Inflation Reduction Act Tri County A C And Heating

What Is A Home Improvement Tax Credit With Pictures

Lincoln Ne Home Remodeler Tax Tips Insideout Renovations

Home Insulation Are There Energy Efficient Tax Credits Attainable Home

Are Home Improvements Tax Deductible Forbes Home

What Home Improvements Are Tax Deductible 2022 2023

How To Cash In On Billions In Green Home Improvement Tax Credits And Rebates Worldnewsera

10 Tax Deductions For Home Improvements Howstuffworks

Inflation Reduction Act And Tax Credits For Energy Efficient Home Improvements Kiplinger

Green Home Improvement Tax Credits

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Five Great Tax Tips For New Socal Homeowners Rwt Design Construction

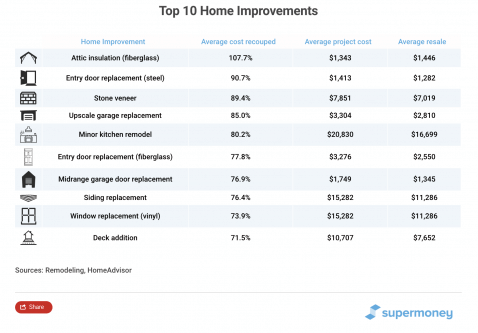

Are Home Improvement Loans Tax Deductible Not Always Supermoney

Better Than Free Italy Offers 110 Tax Credit For Energy Efficiency Home Improvements Power Integrations Inc